Investor Relations

Information to help investors gain a deeper insight into who we are

- HOME >

- Investor Relations >

- Overview >

- Financial Data

Overview

We are a company with a robust financial base, high profitability and stability.

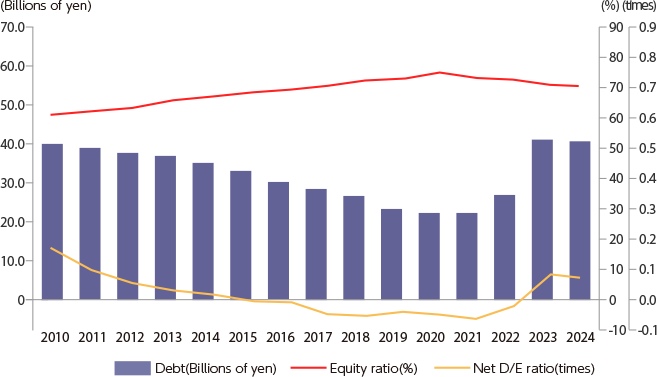

Stable Financial Structure

Nissan Chemical has built up a robust financial base, having given careful consideration to a balance between shareholders’ equity and debt. As the figure below shows, our equity ratio remains high.

Although the debt balance has slightly increased recently, we have maintained it at a level that allows us to sustain a high credit rating from the Japan Credit Rating Agency (JCR).

Accordingly, our Net D/E ratio which is one of the key financial indicators keeps low.

(Lower Net D/E ratio is preferable).

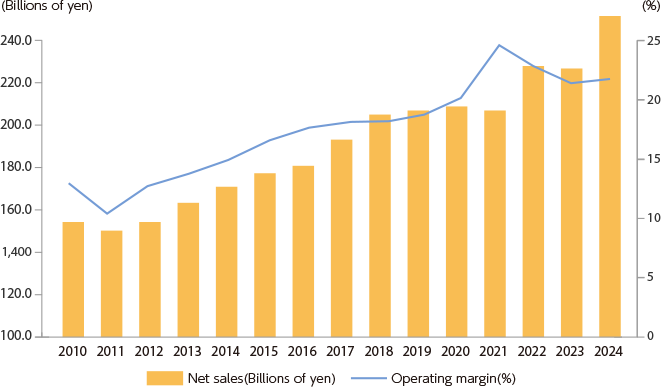

Stable and high profitability

We have achieved high profitability and stability over an extended period of time thanks to our well-balanced business Portfolio that generates stable income streams and high margin returns that drive our growth.

Details on financial data here

Glossary

- Equity ratio: Shareholders’ equity ÷ Total assets

The ratio of capital that does not need to be repaid to total assets.

This ratio shows the stability of a company’s management. - Net D/E ratio (Net Debt Equity Ratio) : (Debt – Cash) / Shareholders’ equity

This ratio shows the extent of a company’s debt compared to its shareholders’ equity.

The lower the number the sounder a company’s financial standing. - Operating margin: Operating income ÷ Net sales

The ratio of operating income to net sales. This ratio shows the profitability of a company’s core business.