Corporate Profile

- HOME >

- Corporate Profile >

- Corporate Governance

Corporate Governance

Policy/Philosophy

We think of corporate governance as a mechanism that ensures sound, efficient management to provide stakeholders with sustainable, medium- to long-term profits. Based on this idea, we strive to ensure management decisions are made promptly, and work to clarify the management responsibility and responsibility for executing operations. At the same time, we take initiatives for strengthening the management’s monitoring function, compliance, risk management, and internal control system under our Board of Directors and Audit & Supervisory Board, whose members include highly independent outside officers.

Compliance with the Corporate Governance Code

We comply with every principle of Japan's Corporate Governance Code.

Strategic Shareholdings

The Company has established the following items regarding strategic shareholdings.

(1) Policy on strategic shareholdings

Each year, the Board of Directors comprehensively discusses the Company’s strategic shareholdings, including aspects such as the necessity of maintaining or enhancing transactional and other relationships with the investee company, whether the benefit of holding the shares is commensurate with the capital cost, and whether such holdings will contribute to increases in the Company’s corporate value over the medium to long-term. If no rationality for holding the shares can be confirmed, then the shares are sold, while also giving consideration to the impact on the market and other pertinent matters.

(2) Policy on the exercise of voting rights on strategic shareholdings

Before exercising its voting rights, the Company comprehensively determines whether it approves or rejects each of the proposals, giving adequate weight to the management policies, strategies, and other aspects of the investee company and confirming such factors as whether the proposals would comply with the Company’s holding policy and whether they would contribute to increasing the investee company’s corporate value over the medium to long-term and its shareholder returns.

Policy and Procedures in the Nomination of Officer Candidates

Nominations of director candidates and audit & supervisory board member candidates are explained in advance to the independent outside directors. Then, after receiving appropriate advice from the independent outside directors and the contents of the Nomination and Remuneration Advisory Committee’s deliberation, the Board of Directors passes a resolution. The candidates are then proposed at the General Meeting of Shareholders. Nominations of Audit & Supervisory Board member candidates are approved by Audit & Supervisory Board in advance.

Policy

| Directors | We operate business activities globally in diverse fields, including chemicals, performance materials, agricultural chemicals, and healthcare. In nominating candidates for our directors, we consider the balance between knowledge, experience, capabilities, and other elements of the overall Board of Directors and its diversity to ensure that our directors can make decisions regarding the business activities in diverse fields, including chemicals, performance materials, agricultural chemicals, and pharmaceuticals, and supervise the execution of operations in an appropriate and flexible manner. The candidates to be nominated shall also be physically and mentally healthy, have excellent personalities and aspirations, and have a high level of insight and ethics. <Inside Directors> Human resources who have expertise, knowledge and other capacities in each business field such as corporate planning, personnel, finance & accounting, research and development, production technology, environment, safety & quality assurance and others. <Outside Directors> Human resources who are capable of giving opinions proactively, raising questions and giving advice on growth strategies, the enhancement of governance and other issues from the viewpoints of various stakeholders and society. Each outside director may serve up to six terms of one year in total; provided, however, that shall not prevent the director from serving up to eight terms of one year in total under a special circumstance. Each outside director may concurrently serve as a director or Audit & Supervisory Board member of five listed companies, including the Company, at a maximum in principle. |

|---|---|

| Audit & Supervisory Board Members | Human resources with a wide range of experience and knowledge in specialized fields including finance, accounting, and legal affairs who are capable of giving opinions and advice to the management from a fair and neutral standpoint, in addition to auditing the execution of operations. Each Audit & Supervisory Board member may serve up to two terms of four years in total; provided however, that shall not prevent the member from serving up to three terms of four years in total under a special circumstance. Each Audit & Supervisory Board member may concurrently serve as a director or Audit & Supervisory Board member of five listed companies, including the Company, at a maximum in principle. |

Reasons for Appointment of Outside Officer and their attendance

| Name | Reason for appointment | Attendance at the Board of Directors meetings in FY2024 (Number of attendance / Number of meetings held) | |

|---|---|---|---|

| Outside Directors |

KATAOKA Kazunori Appointed in June 2020 |

Mr. KATAOKA has been engaged in research involving the application of nanotechnologies in the fields of biomedical engineering and biomaterial engineering for many years and is currently serving as the Director General of Innovation Center of NanoMedicine, Kawasaki Institute of Industrial Promotion. We believe that his expertise as doctor of engineering, abundant experience, and wide-ranging knowledge will be reflected in our corporate management from an outside perspective and from an objective standpoint. | 12/12 |

| NAKAGAWA Miyuki Appointed in June 2021 |

Ms. NAKAGAWA Miyuki worked for many years as a prosecutor in the Tokyo District Public Prosecutors Office and the Tokyo High Public Prosecutors Office and she has abundant practical experience in legal circles. We believe that her expertise as legal profession, abundant experience, and wide-ranging knowledge will be reflected in our corporate management from an outside perspective and from an objective standpoint. | 12/12 | |

| TAKEOKA Yuko Appointed in June 2023 |

Ms. TAKEOKA Yuko has been engaged in research centered on the synthesis and characterization of functional polymers for many years, and is currently serving as a Professor of Department of Materials and Life Sciences, Faculty of Science and Technology, Sophia University. We believe that her expertise as doctor of engineering, abundant experience, and wide-ranging knowledge will be reflected in our corporate management from an outside perspective and from an objective standpoint. | 12/12 | |

| HAMA Itsuo Appointed in June 2025 |

Mr. HAMA Itsuo served as Representative Director, Chairman of the Board of Directors of Lion Corporation, and after that, he has been serving as an Executive Advisor of that company. We believe that his abundant experience and wide-ranging insight as an experienced manager of a corporate group active in diverse sectors of global business centered in Asia will be reflected in the management of the Company from an outside perspective and from an objective standpoint. | - |

| Name | Reason for appointment | Attendance at the Board of Directors meetings, etc. in FY2024 (Number of attendance / Number of meetings held) | |

|---|---|---|---|

| Outside Audit & Supervisory Board Members | KATAYAMA Noriyuki Appointed in June 2014 |

Mr. KATAYAMA has an extensive experience including the experience of outside director/auditor at several companies and expertise as attorney-at-law. We believe that he has reflected his knowledge in our corporate audit and will continue to fulfill the duties appropriately. | Board of Directors meetings: 12/12 Audit & Supervisory Board’s meetings: 12/12 |

| TAKAHAMA Shigeru Appointed in June 2024 |

Mr. TAKAHAMA has been engaged in auditing duties of numerous listed companies for many years as a certified public accountant. We believe that his advanced expertise in corporate accounting, abundant experience, and wide-ranging knowledge will be reflected in the audit of the Company from an outside perspective and from an objective and neutral standpoint. | Board of Directors meetings: 10/10 Audit & Supervisory Board’s meetings: 10/10 |

|

| KINUGAWA Sachie Appointed in June 2025 |

Ms. KINUGAWA was engaged in work at financial institutions for many years, and after that, she had served as President & CEO (Representative Director) of Mizuho Business Partner Co., Ltd. since April 2021. She possesses abundant experience, notably in corporate management, and wide-ranging insights that include financial expertise. We believe that these skills will be reflected in the audit of the Company from an outside perspective and from an objective and neutral standpoint. | - |

Independence Standards for Independent Outside Directors

The Company’s independence standards for Outside Officers are as follows:

The Company’s independent Outside Officers (Directors and Audit & Supervisory Board Members) and independent Outside Officer candidates fulfill the Companies Act’s requirements for Outside Officers, as well as the following independence standards.

(1) Not being an executive (a person who executes business; hereinafter, the same) of the Company or its subsidiaries, nor having been an executive of the Company or its subsidiaries for the past 10 years (if however, a non-executive director or audit & supervisory board member of the Company or its subsidiaries at some point in the past 10 years, the 10 years prior to being appointed to that role)

(2) Not being one of the Company’s major shareholders (a shareholder with 10% or more of voting rights) or an executive thereof

(3) Not being an executive of a corporation of which the Company is a major shareholder (a shareholder with 10% or more of voting rights)

(4) Not being a major client or supplier (a client or supplier from whom the value of average payments for transactions to the Company or its subsidiaries over the past 3 fiscal years exceeds 2% of the average annual consolidated net sales of the Company over the past 3 fiscal years) of the Company or its subsidiaries or an executive thereof

(5) Not being a party whose major client or supplier is the Company or its subsidiaries (a party to whom the value of average payments for transactions by the Company or its subsidiaries over the past 3 fiscal years exceeds 2% of the average annual consolidated net sales of that party over the past 3 fiscal years), or an executive thereof

(6) Not being an executive of a major financial institution with which the Company has borrowings (a financial institution from whom the average amount of the Company’s consolidated fiscal-year-end balance of borrowings over the past 3 fiscal years exceeds 2% of the Company’s average annual consolidated fiscal-year-end total assets over the past 3 fiscal years) nor having been an executive thereof for the past 3 years

(7) Not being an attorney, certified public accountant, certified public tax accountant, other consultant, researcher or educator in receipt from the Company of a large amount of monetary consideration or other property (an average annual amount over the past 3 fiscal years of over ¥10 million for individuals or, in the event the recipient is a corporation or other organization that said individual is affiliated with or retained by, of an amount in excess of 2% of that organization’s average annual total revenues over the past 3 fiscal years) other than Director or Audit & Supervisory Board Member remuneration

(8) Not being a close relative (spouse, person within the second degree of kinship or relative living together) of an executive (limited to key personnel) of the Company or its subsidiaries

(9) In addition to items (1) through (8) above, being such person as the Board of Directors determines to be a person whose independence as an independent Outside Officer is unquestionable and for whom there is no rationally determined risk of a conflict of interest with the general shareholders of the Company.

Overview of Succession Plan for President and CEO

(1) Purpose of Succession Planning

To ensure the Company’s sustainable development and enhancement of the mid-to-long term corporate value, we, the Company, recognize that it is indispensable to replace our President and CEO with an adequate successor at an appropriate time. To actualize such replacement, we formulate the “Succession Plan for President and CEO” (“Plan”), which is resolved by the Board of Directors.

(2) Basic Idea

In the Plan, looking at the future replacement of our President and CEO, we select and train potential candidates for succession and develop their knowledge, skills, and abilities as required before identifying a person who perfectly fits, as a principle.

(3) Road Map

We compile a road map of necessary processes to implement the Plan appropriately.

(4) Roles and Functions

In the Plan, the President and CEO, the Nomination and Remuneration Advisory Committee, and the Board of Directors have their respective roles and functions as follows:

- 1)President and CEO

The President and CEO prepares an original draft of the Plan and puts it into practice. - 2)Nomination and Remuneration Advisory Committee

To enhance its supervisory function in the Plan, the Committee thoroughly reviews and deliberates the original draft of the Plan and its implementation progress and reports it to the Board of Directors to support their proactive engagement in the Plan. - 3)Board of Directors

Based on the Committee’s report, the Board of Directors checks the implementation progress and oversees the whole process so that the Plan is appropriately carried out through its proactive engagement.

Policy on Determination of Officers' Remuneration

1. Basic policy

In determining remunerations for our Directors, we, the Company, maintain, as our fundamental principle, the remuneration structure that encourages the Directors to contribute to increasing operating performance on a continuing basis over the medium-to-long-term and toward enhancing the overall value of the Group in line with the Company’s management policy; thereby, meeting our shareholders’ expectations. Under the principle, we make it our basic approach to set the appropriate level of remunerations, taking into account such factors as the management environment, operating performance, and consistency with payments and benefits for our employees.

Specifically, the Directors' remuneration package shall consist of monetary remuneration (base remuneration and performance-related one) and performance-linked stock compensation. However, the Outside Directors’ remuneration package shall consist of only the base remuneration as a monetary payment. In the light of their roles and independence from the Company, their remuneration package does not contain the performance-related remuneration as monetary payment nor the performance-linked stock compensation.

By clarifying the link between the performance and its stock price and sharing between Directors and shareholders the risk of a decline in the stock price, as well as the benefits of its increase, the performance-linked stock compensation for Directors (excluding Outside Directors) aims to increase their motivation for contributing to improving the Company’s operating performance over the medium to long term.

2. Policy on determining the respective amounts of monetary remuneration (base remuneration and performance-related one) for individual Directors (including rules on determining the time or the conditions of payment)

The base remuneration of monetary one for Directors shall be a fixed pay. The annual amount of the fixed payment shall be determined depending on their titles and duties, and holistically considering the level of other companies’ directors’ payments, the Company’s operational performance, and our employees’ salaries level.

For the performance-related remuneration, we establish the base amount for each title and determine the annual amount according to the fluctuation of performance indicators. Those indicators consist of the profit indicators for the previous fiscal year (the net income attributable to owners of the parent, EBITDA, and the like) and ESG indicators (the third-party assessment result, the reduction of GHG emissions, and the like.)

The Company pays the above monetary remunerations to Directors not to exceed the limits of the total amount of Directors’ remunerations determined by resolution at a general meeting of shareholders, respectively, every month in twelve installments.

3. Policy on determining details of performance-linked stock compensation, the breakdown of performance indicators, and the methodology to calculate the amount or the number of evaluation points for performance measurement (including rules on determining the time or the conditions for giving the stock compensation)

As for the performance-linked stock compensation for the Directors, every fiscal year, the Company shall compute a specific number of evaluation points for each Director by multiplying (i) his/her title point depending on the job title which he/she has assumed during the execution of duties by (ii) the performance measurement index showing the achievement of the performance targets consisting of income attributable to owners of our parent company (the average rate of change over the last three years), EBITDA (average rate of change over the last three years), ROE (actual results for the current fiscal year), as well as the comparison of rates of year-on-year volatility with respect to the Company’s stock price and TOPIX, provide that the above evaluation points to be given to the Directors shall be up to the limit determined by the resolution of a general shareholders’ meeting. The above evaluation points shall be accumulated until the retirement of each Director, respectively. At the same time, the Company shall contribute a specific amount of cash to the Board Benefit Trust as its funds up to the limit determined by resolution of a general shareholders’ meeting. Upon the retirement of a Director, the Company shall vest him/her a specific number of the Company’s stock equivalent to the number of his/her accumulated evaluation points. When a Director retires for the expiration of his/her term of office, he/she will be given the Company’s stock equivalent to about 75% of the accumulated evaluation points and the remaining approximately 25% in cash (which sum is computed at the current price of the Company’s stock at the time of his/her retirement).

When formulating the Company’s medium-term business plan, the performance indicators and their targets, or the basis of granting evaluation points, shall be reset. The Company determines those indicators and targets by the Board of Directors’ resolution based on advice from the Nomination and Remuneration Advisory Committee.

4. Policy on determining the proportion of monetary remuneration and performance-linked stock compensation to the total remunerations for individual Directors

For the proportion of each of the Directors’ remuneration types (except for Outside Directors), the Nomination and Remuneration Advisory Committee shall deliberate based on the remuneration levels in the industry using the data of other companies in similar business sizes as the Company as well as related business types and categories as a benchmark. The Board of Directors shall respect the Nomination and Remuneration Advisory Committee's proposal and determine details of remunerations for individual Directors within the respective limits of each remuneration type suggested in the proposal.

When formulating the Company’s medium-term business plan, the rough proportion of the respective remuneration types shall be reset and determined by the Board of Directors’ resolution based on advice from the Nomination and Remuneration Advisory Committee. Currently, the following proportion is effective as fixed when formulating the medium-term business plans starting in the fiscal year 2022.

The proportion of the base remuneration (monetary remuneration), the performance-related remuneration (monetary remuneration), and the performance-linked stock compensation to the total remunerations shall be 65:28:7 (where the achievement of the performance indicators’ targets is 100%).

5. Matters regarding the decision on details of remunerations for individual Directors

The amount of the monetary remuneration (consisting of base remuneration and performance-related one) for individual Directors shall be determined by the Board of Directors' resolution. The Board of Directors shall submit the original draft on those respective amounts prepared by the Representative Director to the Nomination and Remuneration Advisory Committee and seek and receive advice. The Board of Directors must respect that advice given to make its decision.

6. Other matters regarding the process to determine details of remunerations for individual Directors

The Company has established the Nomination and Remuneration Advisory Committee as an advisory body to the Board of Directors. Accordingly, the Company shall ask the Nomination and Remuneration Advisory Committee to deliberate and advise on the establishment, amendment, or abolishment of any existing policy regarding the Directors’ remunerations and the determination of the Directors’ monetary remuneration, to ensure the appropriateness of the remuneration levels as well as objectivity and transparency of the decision-making process. The Nomination and Remuneration Advisory Committee shall consist of three committee members or more to be appointed by resolution of the Board of Directors, and independent Outside Directors shall form its simple majority.

(※)Under the Company’s performance-linked stock compensation plan, the Company has established a so-called malus provision, whereby unvested stock compensation of a Director will be forfeited in exceptional circumstances, such as in case of retirement of such Director due to his/her misconduct.

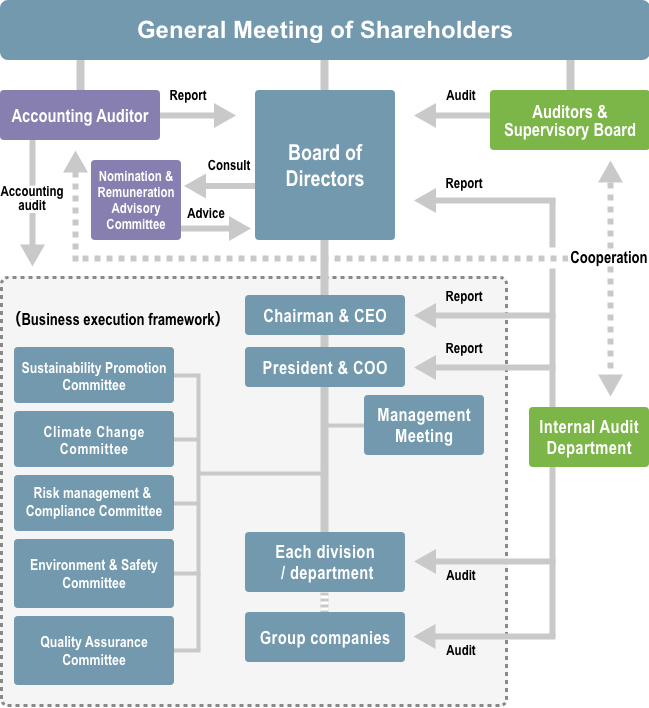

System

Our Corporate Governance System

Execution and supervision of operations

By introducing a system with executive officers, we clarify the management’s function of prompt decision-making and supervision and the function of executing operations, thereby strengthening both. We also strive to improve management’s capabilities to develop and execute our management strategies. In addition, we have set a one-year term for each director and executive officer, thereby clarifying the management responsibility and the responsibility for executing operations.

Board of Directors

Our board meets monthly in principle, to resolve important management matters. It also supervises the execution of operations by directors and executive officers. We ensure that important management matters are determined through careful deliberations at the Board of Directors meetings or management meetings in our efforts to eliminate or reduce business risks. In addition, the details of decisions made at the management meetings and the results of business executions based on decisions made at the Board of Directors meetings, etc. are reported to the Board of Directors to enhance the supervising function of the Board of Directors meeting. We further strive to ensure and improve effectiveness in execution of roles and responsibilities of the Board of Directors by conducting the effectiveness evaluation on the overall Board of Directors every fiscal year.

Audit & Supervisory Board

We have established the Audit & Supervisory Board. In accordance with auditing plans formulated by the Audit & Supervisory Board, the Audit & Supervisory Board members audit the execution of directors’ operation by participating in the Board of Directors meetings and other important meetings, and by regularly visiting each division / department of the Head Office and plant / laboratory to exchange opinions.

Accounting Audit

We have appointed the Yaesu Audit Company as our accounting auditor. They audit at the end of each fiscal year, and during the fiscal year when necessary.

Internal Audit

We have established an Internal Audit Department to pursue the achievement of the Group’s management objectives effectively. With the object of ensuring the proper duties under the internal control system, the Internal Audit Department conducts internal audits for the Group. The department submits its internal audit activity plan and reports the outcomes to the Chairman & CEO, the President & COO, the directors in charge, and the Board of Directors. It also shares information with our accounting auditor and the Audit & Supervisory Board members to cooperate with them.

Support for Outside Directors and Audit & Supervisory Board Members

The Corporate Planning Department supports outside directors by giving them prior explanations of the contents of the agenda and other matters to be discussed at the Board of Directors meetings, and serves as a contact for inquiries. For outside Audit & Supervisory Board members, we have appointed audit assistants in response to requests from them. Audit assistants are employees who help outside Audit & Supervisory Board members fulfill their duties efficiently and smoothly. They serve as coordinators for holding internal audits, Audit & Supervisory Board’s meetings, and other meetings, help outside Audit & Supervisory Board members conduct audits, and collect and provide information to them.

Nomination and Remuneration Advisory Committee

We have established under the Board of Directors a Nomination and Remuneration Advisory Committee mostly consisting of independent outside directors for the purpose of strengthening the Board of Directors’ independence, objectivity and accountability in relation to matters such as the nomination and remuneration of Directors and further strengthening corporate governance. In response to the Board of Directors’ request for consultation, the Committee shall deliberate the matters such as the nominations of director candidates and Audit & Supervisory Board member candidates, the appointment of senior management, the plans for successors of senior management, and the remuneration of directors, and report the contents of their deliberations to the Board of Directors.

Relationships between our corporate organizations and internal control, etc.

Indicators

Governance System※

| Indicator | Scope | Unit | FY2021 | FY2022 | FY2023 | FY2024 | |

|---|---|---|---|---|---|---|---|

| Directors | Inside directors | Male | People | 6 | 6 | 6 | 6 |

| Female | People | 0 | 0 | 0 | 0 | ||

| Total | People | 6 | 6 | 6 | 6 | ||

| Outside directors (Independent) |

Male | People | 3 (3) | 3 (3) | 2 (2) | 2(2) | |

| Female | People | 1 (1) | 1 (1) | 2 (2) | 2(2) | ||

| Total | People | 4 (4) | 4 (4) | 4 (4) | 4(4) | ||

| Altogether | People | 10 (4) | 10 (4) | 10 (4) | 10(4) | ||

| Ratio of independent outside directors | % | 40 | 40 | 40 | 40 | ||

| Ratio of female directors | % | 10 | 10 | 20 | 20 | ||

| Audit & Supervisory Board members | Inside Audit & Supervisory Board members | Male | People | 1 | 1 | 1 | 1 |

| Female | People | 0 | 0 | 0 | 0 | ||

| Total | People | 1 | 1 | 1 | 1 | ||

| Outside Audit & Supervisory Board members (Independent) |

Male | People | 3 (3) | 3 (3) | 3 (3) | 3 (3) | |

| Female | People | 0 | 0 | 0 | 0(0) | ||

| Total | People | 3 (3) | 3 (3) | 3 (3) | 3(3) | ||

| Altogether | People | 4 (3) | 4 (3) | 4 (3) | 4(3) | ||

| Ratio of independent outside Audit & Supervisory Board members | % | 75 | 75 | 75 | 75 | ||

| Ratio of female Audit & Supervisory Board members | % | 0 | 0 | 0 | 0 | ||

- Data is as of after the General Meeting of Shareholders held in June of each year.

Number of Major Meetings and Attendances※

| Indicator | Unit | FY2021 | FY2022 | FY2023 | FY2024 |

|---|---|---|---|---|---|

| Board of Directors meeting | Times | 12 | 12 | 12 | 12 |

| Attendance of directors at Board of Directors meetings | % | 99.2 | 98.3 | 99.2 | 100 |

| Attendance of Audit & Supervisory Board members at Board of Directors meetings | % | 100 | 100 | 100 | 100 |

| Audit & Supervisory Board’s meeting | Times | 12 | 12 | 12 | 12 |

| Attendance of outside Audit & Supervisory Board members at Audit & Supervisory Board’s meetings | % | 100 | 100 | 100 | 100 |

- Data from April to March of each fiscal year

Officers' Remuneration

| Indicator | Unit | FY2021 | FY2022 | FY2023 | FY2024 | |

|---|---|---|---|---|---|---|

| Directors | Remuneration | Million Yen | 437 | 466 | 471 | 457 |

| Number of officers※1 | People | 11 | 13 | 11 | 10 | |

| (outside directors) | Remuneration | Million Yen | (44) | (51) | (52) | (52) |

| Number of officers※1 | People | (4) | (4) | (5) | (4) | |

| Audit & Supervisory Board members | Remuneration | Million Yen | 93 | 96 | 98 | 86 |

| Number of officers※1 | People | 4 | 5 | 4 | 5 | |

| (outside Audit & Supervisory Board members) | Remuneration | Million Yen | (65) | (67) | (68) | (56) |

| Number of officers※1 | People | (3) | (3) | (3) | (4) | |

| Total※2 | Remuneration | Million Yen | 530 | 562 | 570 | 543 |

| Number of officers※1 | People | 15 | 18 | 15 | 15 | |

- 1 Above number of Directors and Audit & Supervisory Board Members, remuneration , etc. include remunerations for officers who resigned at the close of General Meeting of Shareholders. There are no officer’s remuneration, etc. received by outside officers from our subsidiaries.

- 2 Due to rounding off figures, there are places where the sums for each item do not match the total.

Activities

Analysis and Evaluation of the Board of Directors’ Effectiveness as a Whole

Overview of Effectiveness Evaluation of the Board of Directors

Every year since fiscal year 2015, the Company analyzes and evaluates to assess whether our Board of Directors has fulfilled its key roles and responsibilities (“Effectiveness Evaluation”). For the evaluation process, primarily employing the self-assessment process by the Board of Directors, the Company alternatively conducts a third-party evaluation every three (3) years using an external organization that has no relationship of interest with us to ensure the neutrality and objectivity of the evaluation.

For the Effectiveness Evaluation for fiscal year 2024, the Company performed the self-assessment process. At the Board of Directors meeting held in April 2025, the board members shared, analyzed, and evaluated the questionnaire responses and discussed the issues to address. The outcomes of their analysis and evaluation, the selection of the priority issues to address, and the action plan to solve those issues were further deliberated and confirmed at the Board of Directors’ meeting held in May 2025.

Overview of the Results of the Effectiveness Evaluation

With the object of performing its key roles and responsibilities, the results of the Effectiveness Evaluation concluded that, generally, the Company’s Board of Directors was operating appropriately in its totality, and the improvements have been overall made to solve issues identified in the Effectiveness Evaluation for the fiscal year 2023. Thus, the effectiveness of the overall Board of Directors was positively assessed and confirmed as being sufficiently ensured.

Actions to Take

The Board of Directors acknowledged the following points as issues to address in fiscal year 2025 and confirmed the action plan to take.

- (1)Issues to address: We should deepen our discussions on how to approach “risk-taking in investment” and what principles to follow.

- (2)Action plan: We should have free discussions and otherwise take out time to discuss “risk-taking in investment” over several meetings of the Board of Directors.